by House Trevethan Staff | Feb 21, 2023 | For Buyers, For Sellers, Housing Market Updates, Interest Rates

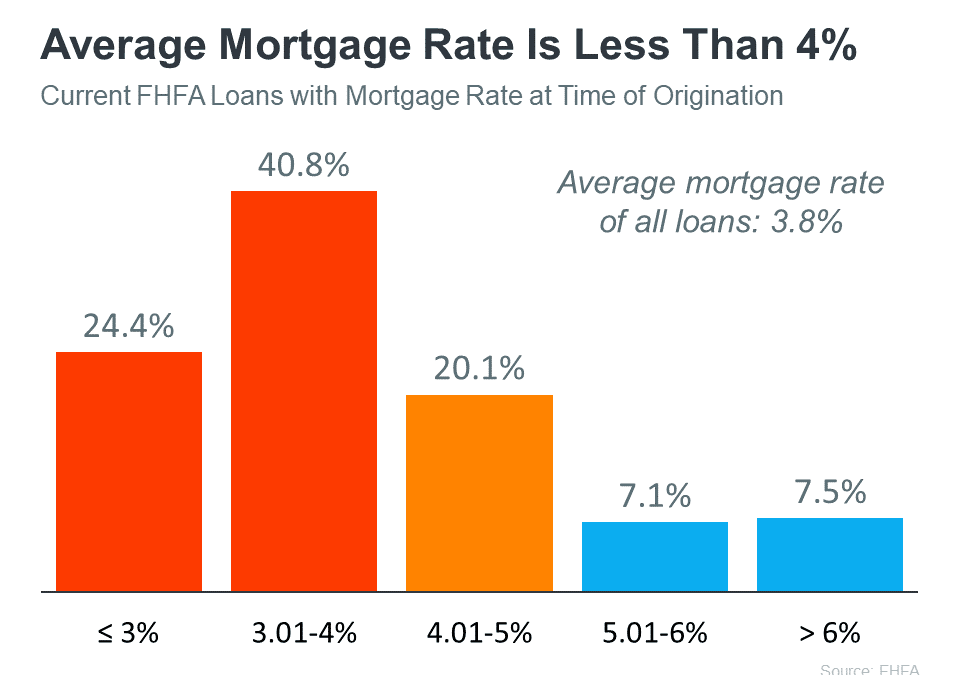

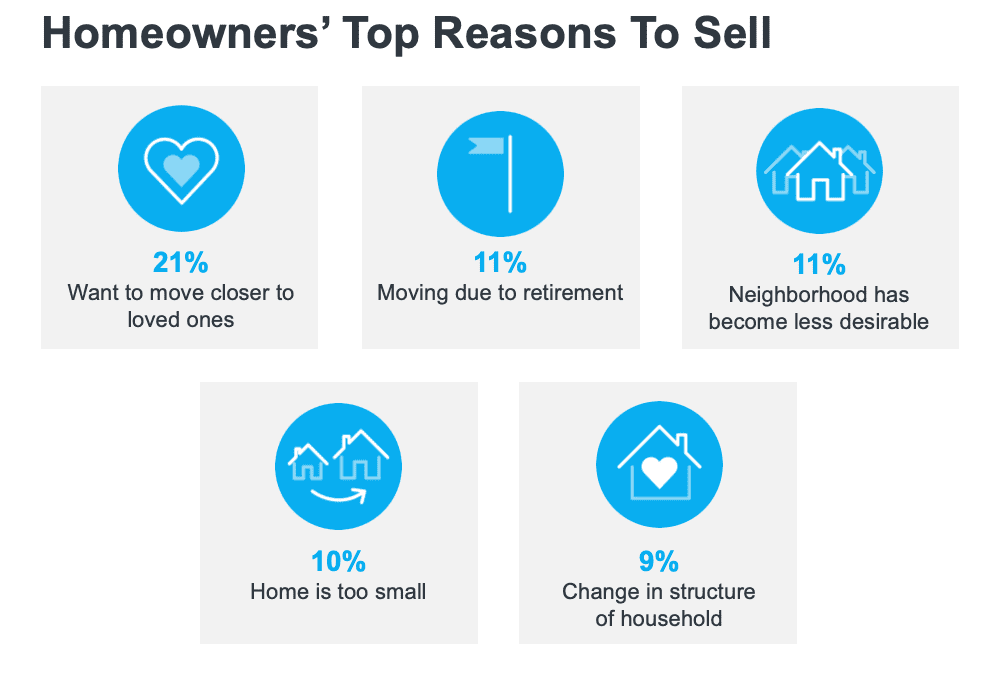

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:“Two dynamics are keeping existing-home inventory historically low – rate-locked...

by House Trevethan Staff | Feb 6, 2023 | For Sellers, Interest Rates, Selling Myths

Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting to lose the low mortgage rate they have...

by House Trevethan Staff | Jan 24, 2023 | First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers, Pricing

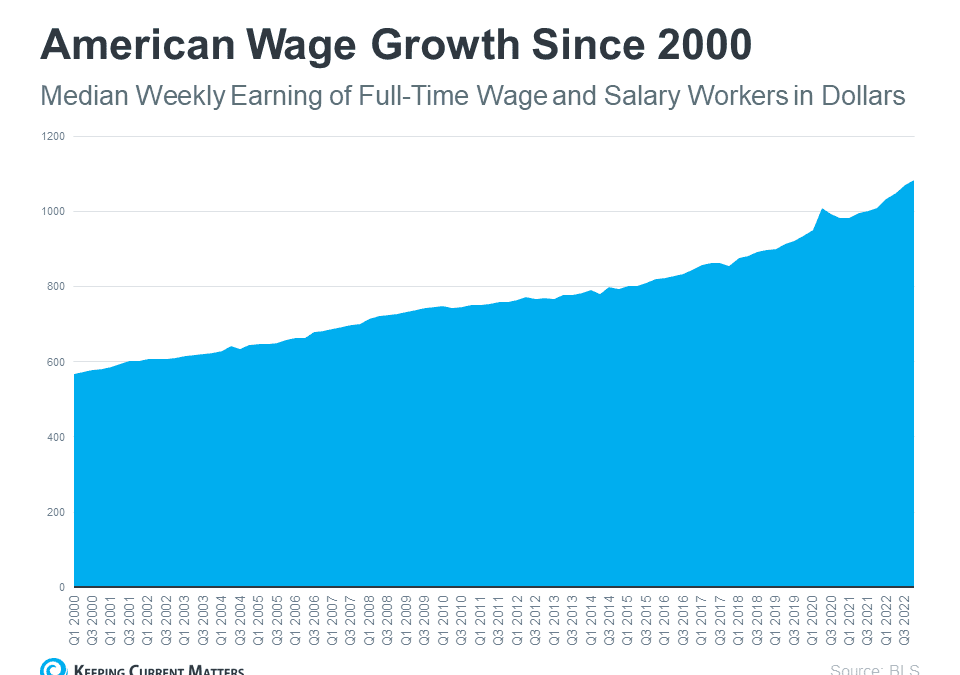

If you’ve been following the housing market over the last couple of years, you’ve likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve this year. Selma Hepp,...

by House Trevethan Staff | Jan 17, 2023 | Buying Myths, First Time Home Buyers, For Buyers, Interest Rates, Move-Up Buyers

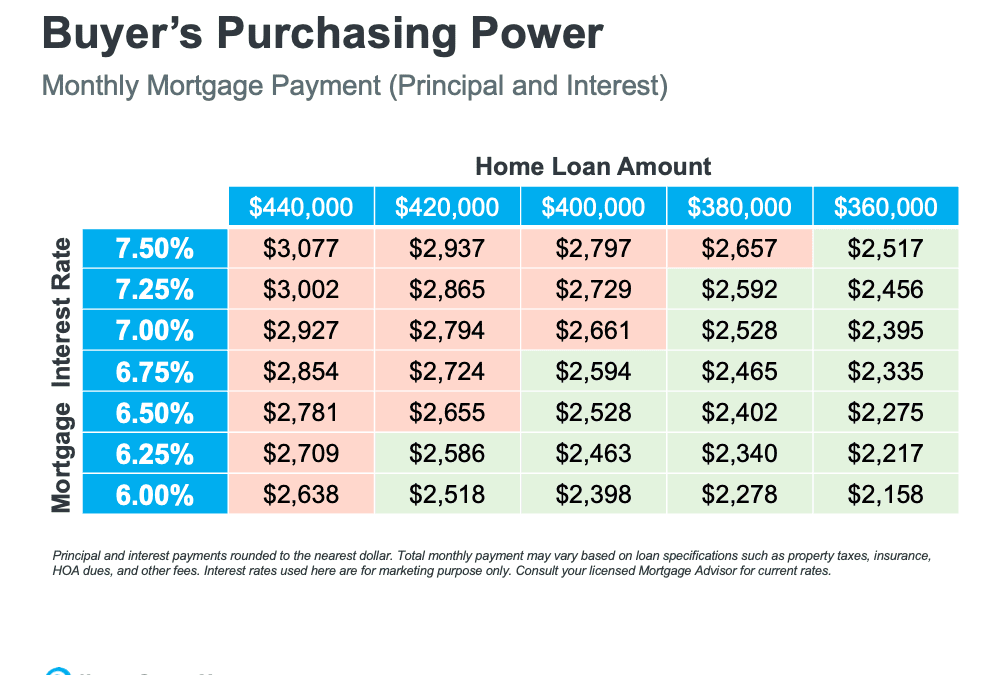

Last year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a hit to their purchasing...

by House Trevethan Staff | Dec 21, 2022 | Content Hub, For Buyers, For Sellers, Housing Market Updates, Interest Rates, Pricing

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position.As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more...

by House Trevethan Staff | Dec 19, 2022 | Buying Myths, Content Hub, First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers

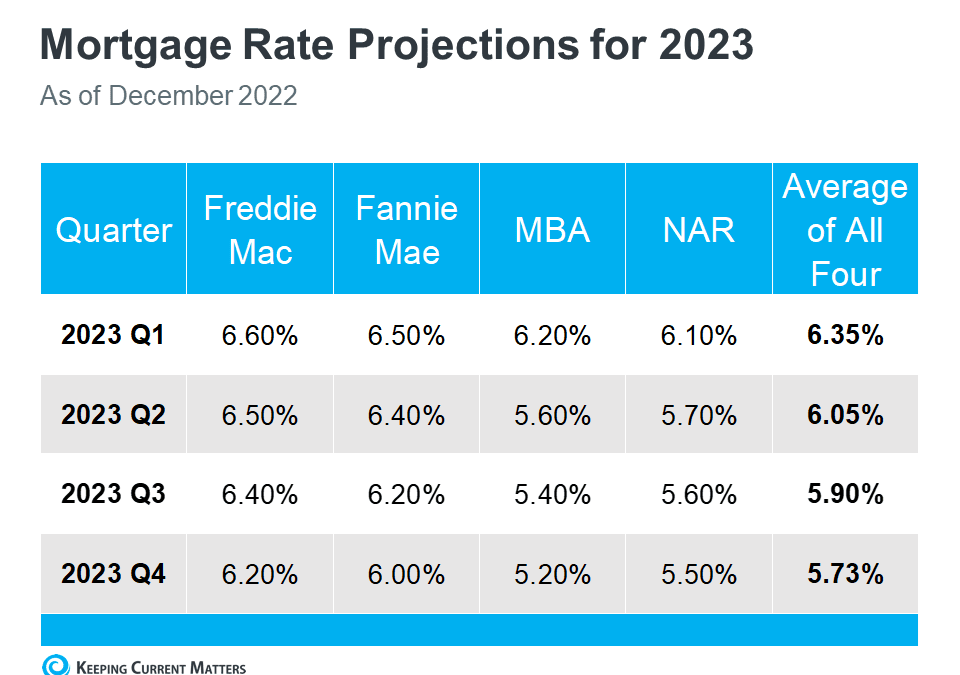

Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they’re dropping, and that has to do with everything happening in the economy.Nadia Evangelou, Senior Economist...