by House Trevethan Staff | Jul 11, 2022 | Content Hub, First Time Home Buyers, For Buyers, Housing Market Updates, Interest Rates, Move-Up Buyers

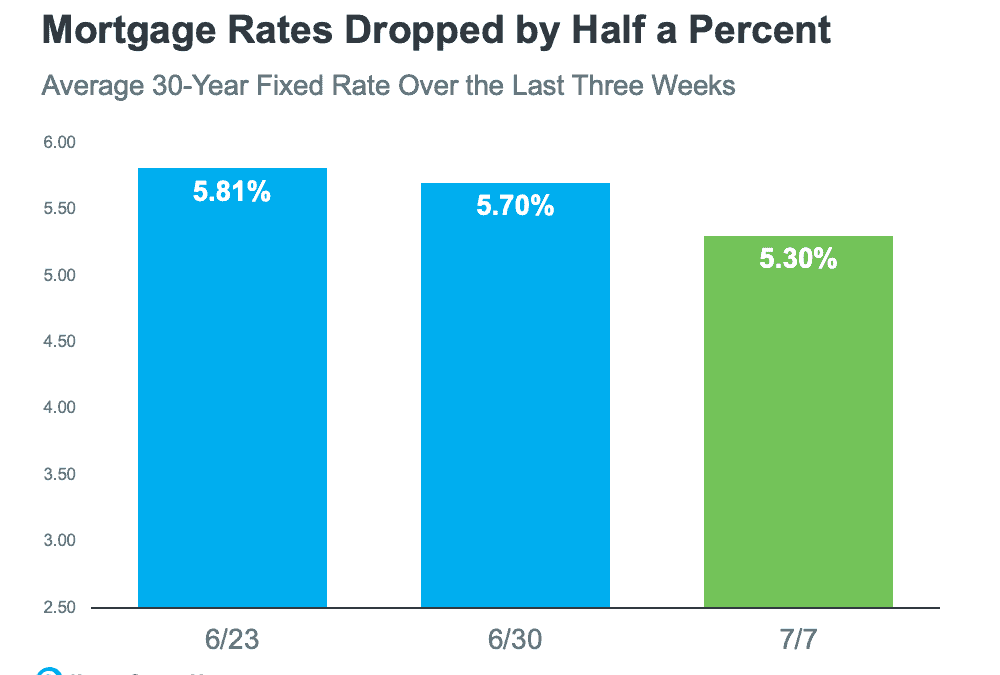

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see...

![Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC]](data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMSIgaGVpZ2h0PSIxIiB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciPjwvc3ZnPg==)

by House Trevethan Staff | Jul 8, 2022 | For Sellers, Housing Market Updates, Infographics, Move-Up Buyers, Pricing

Some Highlights According to the latest data from CoreLogic, the average homeowner gained $64,000 in home equity over the past 12 months. That much equity can be a game-changer when you move. When you sell, it could be some (if not all) of what you need for a down...

by House Trevethan Staff | Jul 6, 2022 | Content Hub, For Sellers, Move-Up Buyers, Pricing

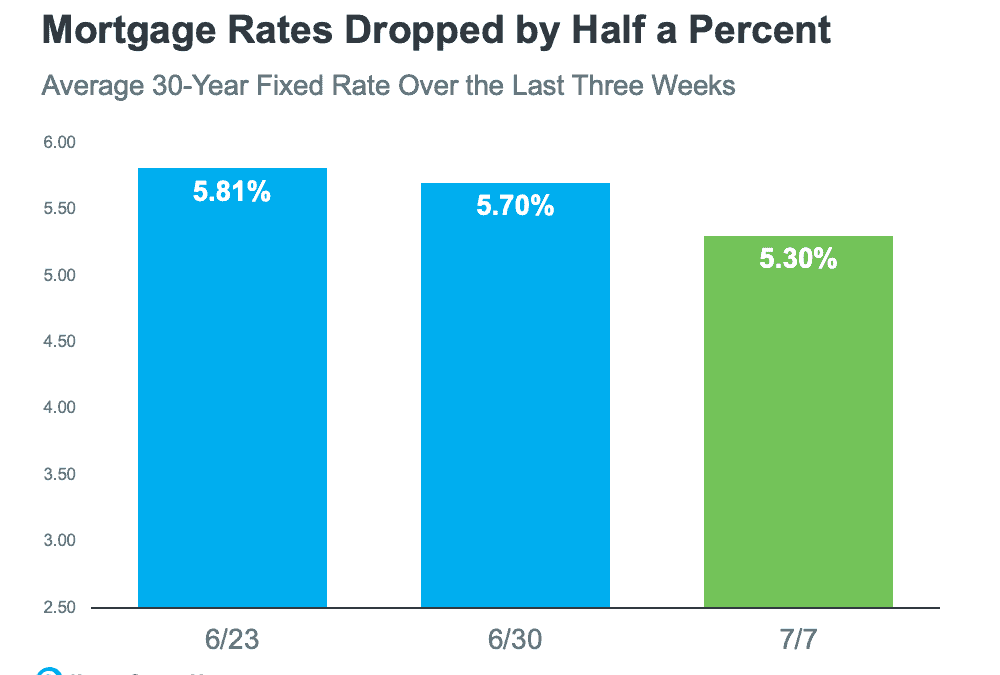

It’s true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says:“The stunning jump in home values over the course of the Covid-19...

![Real Estate Consistently Voted Best Investment [INFOGRAPHIC]](data:image/svg+xml;base64,PHN2ZyB3aWR0aD0iMSIgaGVpZ2h0PSIxIiB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciPjwvc3ZnPg==)

by House Trevethan Staff | Jul 1, 2022 | First Time Home Buyers, For Buyers, Housing Market Updates, Infographics, Move-Up Buyers

Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Owning real estate is more than just a place to call home. It’s also an investment in your future. That’s because it’s typically a stable...

by House Trevethan Staff | Jun 28, 2022 | First Time Home Buyers, For Buyers, Housing Market Updates, Move-Up Buyers

There’s no denying the housing market has delivered a fair share of challenges to homebuyers over the past two years. Two of the biggest hurdles homebuyers faced during the pandemic were the limited number of homes for sale and the intensity and frequency of bidding...

by House Trevethan Staff | Jun 22, 2022 | First Time Home Buyers, For Buyers, Move-Up Buyers

Once you’ve applied for a mortgage to buy a home, there are some key things to keep in mind. While it’s exciting to start thinking about moving in and decorating, be careful when it comes to making any big purchases. Here are a few things you may not realize you need...

![Why Growing Home Equity Is Great News if You Plan To Move [INFOGRAPHIC]](https://sheridanpropertygroup.com/wp-content/uploads/2022/07/20220708-NM-1080x675.png)

![Real Estate Consistently Voted Best Investment [INFOGRAPHIC]](https://sheridanpropertygroup.com/wp-content/uploads/2022/07/20220701-NM-1080x675.png)